Buying a house in Florida has more perks than just the sunny weather. In fact, many people who retire to Florida do so for lower property tax rates and the homestead exemption. Both of which make owning a Floridian home a lot more affordable.

Below, we’ll take a look at the Florida homestead exemption and how you might be able to take advantage and lower your tax burden. Plus, how to apply if you live in Palm Beach County.

What is the Florida Homestead Exemption?

Florida’s homestead exemption reduces the taxable value of your home by up to $50,000.

Specifics of the exemption include:

- The first $25,000 of assessed home value is exempt from all property taxes, including school taxes

- An additional up to $25,000 exemption applies to the assessed value between $50,000 to $75,000, not including school taxes

To simplify, if your home is worth over $75,000 you will receive an exemption of $50,000. Half of it will exempt all property taxes, and the other half will exempt everything except for school taxes.

How Much Money Will I Save in Taxes?

If your home is valued over $75,000 in Palm Beach County, then it’s likely in 2024 you will save roughly $600-$1,000 per year with the homestead exemption. This is because every homeowner who qualifies and has an assessed value over $75,000 will receive the same exemption of $50,000. So regardless if your home is worth $150,000 or $3,000,000 – the exemption is the same amount of $50,000 in reduced tax assessment. The variance in savings will come from local tax rates for each municipality.

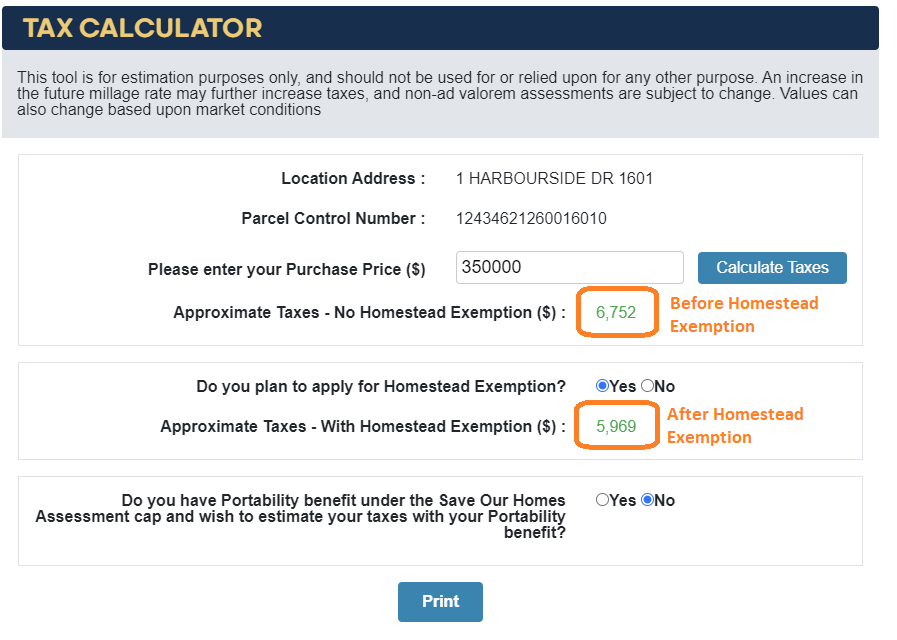

To get an exact calculation of home much the homestead exemption will save you follow these steps:

- Visit The Palm Beach County Appraisers Tax Calculator

- In the search box, type and select address for the home you want to calculate the tax savings on.

- Enter your assessed home value, or purchase price of the home you are looking to buy.

- Click “yes” to the question of “Do you plan to apply for Homestead Exemption”.

- Calculate Taxes

The results will show you your expected tax burden with any without the homestead exemption. See image below for an example

Who Qualifies for the Florida Homestead Exemption?

The house and homeowner must both qualify for the Florida homestead exemption.

Homeowner Qualification Criteria

- Must own and occupy a home in Florida that you’re claiming as your permanent residence

- Must be a U.S. citizen or permanent resident

- Must establish residency in the county in Florida where the home is located

- Must have lived in the home on January 1 of the tax you that plan to claim the exemption

- Must submit a completed homestead application on or before March 1st of the year that you plan to apply for the exemption

Property Qualification Criteria

- The home must be used as the taxpayer’s primary residence—vacation homes or second homes are not eligible

- The home should not have been rented out for more than 30 days in the calendar year

How to Apply for the Homestead Exemption in Florida

Homeowners need to fill out an application and provide proof of residency on or before March 1 of the year they plan to claim the exemption. For example, if you want to claim the homestead exemption on your 2023 taxes, you need to apply and provide proof by March 1, 2023.

Applying is as simple as filling out form DR-501. You have a few options for filling out and submitting the form:

- E-file it through your local county appraiser’s office. Here is where you e-file for Palm Beach County.

- Print the form and then mail the completed form to your county appraiser’s office

- Visit a service center in your county to fill out the paperwork in person

Information Needed to Apply For Florida Homestead Exemption

Along with providing personal and house details like your social security number and the address of the property, you must also show proof of residence. The more proof that you’re able to provide on your homestead application, the better.

Proof of residence includes:

- Information about your previous residence out of Florida, if relevant

- Florida driver’s license or ID card number

- Proof that you’ve relinquished a driver’s license from another state

- Florida vehicle tag number

- Florida voter registration card (if you’re a U.S. citizen)

- Declaration of domicile

- Current employer

- Address on your last tax return

- Address of where any dependent children attend school

- Mailing address used on a bank statement or checking account

- Proof of utility payments at the homestead address

The county appraiser’s office will ultimately make the final decision about your homestead application.

Applying for the Florida Homestead Exemption in Palm Beach County

If you live in a Palm Beach County community like Boca Raton or Wellington, you can apply for your homestead exemption online, by mail, or in person.

Apply Online

Visit the Palm Beach County Property Appraiser’s Homestead Exemption webpage to e-file your application.

Apply by Mail

Simply print out a pdf of the homestead exemption application. Then, mail the completed application to:

Palm Beach County Property Appraiser’s Office

Exemption Services

1st Floor

301 N. Olive Ave.

West Palm Beach, FL 33401

Before sending in your application call the property appraisers office to verify the mailing address as this may change.

Apply in Person

Visit one of the county’s five service centers.

Downtown Service Center

Exemptions – 1st Floor

301 North Olive Avenue

West Palm Beach, FL 33401

South County Service Center

14925 Cumberland Drive

Delray Beach, FL 33446

North County Service Center

3188 PGA Boulevard, 2nd Floor

Palm Beach Gardens, FL 33410

Mid West County Service Center

200 Civic Center Way, Suite 200

Royal Palm Beach, FL 33411

Belle Glade Service Center

2976 State Road 15

Belle Glade, FL 33430

How Long Does Florida Homestead Exemption Last?

Fortunately, you only need to apply for the homestead exemption in Florida once. The exemption is automatically renewed each year. You’ll receive a homestead exemption receipt by mail after January 1st of each year to confirm the automatic renewal.

It’s on you, the taxpayer, to notify the property appraiser’s office if you no longer qualify for the exemption. Reasons you may longer qualify include:

- Property is no longer your permanent residence

- Property is being rented out

- Change in property ownership due to a sale, marriage, divorce, or death

FAQS about Florida Homestead Exemption

Can I rent out my homestead property?

Yes, but you can only rent out a homestead property for 30 days or fewer per calendar year. If you rent your property for more than 30 days two-years in a row or for longer than six months, you’re no longer eligible for the homestead exemption. If you no longer qualify, you must notifiy the property appraiser’s office.

What would disqualify me from the Florida homestead exemption?

Actions that suggest to your county that you don’t live in your home as a primary residence could disqualify you from the homestead exemption. For example, getting a driver’s license in a different state, owning a vehicle registered in another state, or registering to vote in a different county. Violating the rental restrictions can also disqualify you.

What are the benefits of the homestead exemption in Florida?

The homestead exemption in Florida reduces how much you’ll owe in property taxes each year. It can save you several hundred dollars per year, depending on the value of your home and the property tax rate. Applying is simple and automatically renews, ensuring you have a lowered property tax bill for every year that you qualify for the exemption.