Ready to move, but only if you can sell your home first? You aren’t alone. According to the National Association of Realtors (NAR), more than half of home buyers in 2022 previously owned a home. Many choose to buy and sell at the same time.

While it may require some extra effort, you can make an offer on a home that’s contingent on selling yours.

What is a Home Sale Contingency?

Like an inspection contingency, a home sale contingency is a clause that’s added to your home sale contract. In simple terms, it means that you’re only going to buy the home if your home sells within a set period of time.

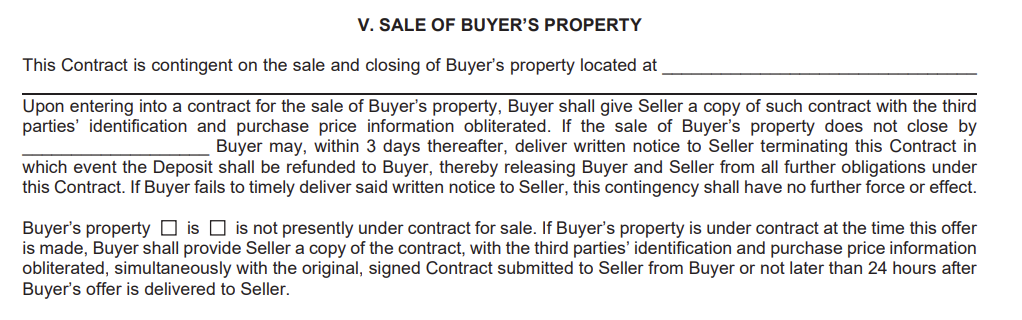

In Florida, realtors use the Sale of Buyer’s Property Rider.

CR-6 – Sale of Buyers Property Rider V (Rev 10_21) (1)

The home buyer must provide the seller with details of the home that they’re selling, including the address and a target closing date.

Why Do Buyers Use a Home Sale Contingency?

Buyers opt for a home sale contingency because they can’t (or don’t want to) have two mortgages. They might also need proceeds from the first home to purchase the second.

The home sale contingency is a safety net for buyers, allowing you to look at and put offers on homes while knowing that you aren’t locked into the sale if your current home doesn’t sell.

If the buyer’s home doesn’t sell in time, they can walk away from the contract and receive their earnest money back.

Watch Out

Having a home sale contingency as part of your offer may make you lose the home. Consider this contingency only if absolutely necessary and understand that it will reduce the strength of your offer.

How Do Sellers Feel About Home Sale Contingencies?

If a seller receives two offers—one with a home sale contingency and one without that are otherwise identical, the seller will go with the one without. Why? Because it’s far less risky. However, not every seller has that luxury, especially in a buyer’s market.

If you’re planning to use a home sale contingency, it’s important to understand that while it gives the buyer a safety net, it puts the risk on the seller.

Some sellers don’t like them, but others are okay with them, especially if your offer is competitive.

How to Buy a Home Contingent On Selling Yours

Selling and buying a home always requires some strategy, but even more so if you want to do both simultaneously. Here are a few tips to make it happen:

Work with a Real Estate Agent

Working with a real estate agent is always a good idea. Even more so when you’re dealing with tricky timing and contingencies.

A good real estate agent can explain the process in-depth, price your home for sale, keep everything on track, and negotiate on your behalf. They also know the market and can help you make a competitive offer that stands out, even with a home sale contingency.

Prepare Your Home for Sale

Ideally, you should put your home on the market before submitting an offer. Have your home decluttered, cleaned, photographed, and listed before you start looking at homes to buy. These actions will show the seller that you’re serious about selling your home and aren’t wasting time.

A seller will be much more likely to accept your home sale contingency if your existing home is already under contract.

Some tips for creating an attractive listing include:

- Working with an experienced listing agent

- Getting professional listing photographs taken

- Including floor plans in your online listing

- Accurately pricing your home

- Providing detailed information on the MLS

Make a Strong Offer

Writing an offer with a home sale contingency already puts you at a disadvantage. That’s why it’s so important to make your offer stand out in other ways. You need to convince the seller that the wait and risk are worth it.

Some ways to make your offer stand out include:

- Competitive purchase price

- Covering some of the seller’s closing costs

- Putting down a larger earnest money deposit than is required

- Offering extra time for the seller to move out after closing

- Adding a kick-out clause

Use the Sale of Buyer’s Property rider

When buying a home contingent on selling yours in Florida, use the Sale of Buyer’s Property Rider. This is what makes your contract actually contingent upon the sale of your home.

If you are not in Florida, your realtor should know which document to use, or your lawyer should know how to draft language to meet your needs.

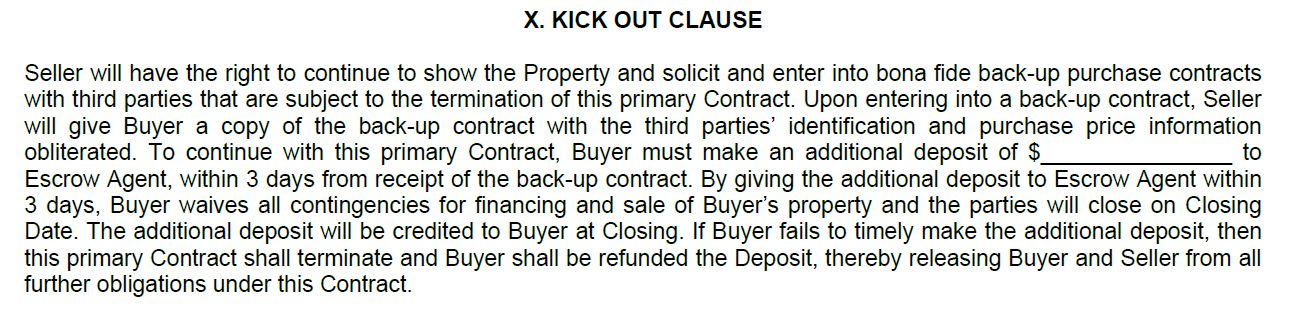

Include a Kick-Out Clause

Just as the home sale contingency is a safety net for buyers, a kick-out clause is a related safety net for sellers. Sellers will be more likely to accept your offer if you include a kick-out clause.

The kick-out clause gives the seller permission to keep their home on the market while you’re trying to sell your home. If another offer comes in that the seller likes, the seller will notify you. Then, you have two to three days to decide if you’re going to drop the home sale contingency or lose out on the home.

In Florida, realtors use the Kick Out Clause rider.

CR-6 – Kick Out Clause Rider X (Rev 10_21)

The Good News About Home Sale Contingencies

Needing to include a home sale contingency with your offer isn’t the end of the world. In May 2020, the National Association of Realtors found that 76% of offers had contingencies, including 6% with a home sale contingency. And only 7% of home sale contracts fell through because of contingencies stated in the contract. So, while it’s possible for a home sale contingency to make the home-buying process a little harder, it doesn’t make it impossible.