If you are looking to buy a home in the post-covid real estate world, then you know how difficult it can be to not only find the right home but to get your offer accepted. If you are serious about submitting a winning bid on a home, follow our guide on how to get your offer accepted and beat out the competition.

If you are new to the home buying process check out this article.

Pre-Approval Letter

A pre-approval letter is a letter from a bank stating that you are approved for a home loan up to a certain dollar amount. The importance of this letter cannot be overstated.

Sellers generally will not consider accepting offers without a pre-approval from a bank, unless you are a cash buyer.

Sellers want to know that you are serious, and you can close on the home. Without this letter, it’s very unlikely your offer would be accepted unless your offering on a property that has been sitting on the market for a very long time, and the seller is willing to roll the dice on whether you could close or not.

How Long Does it Take to Receive a Pre-Approval?

The time it takes to get a pre-approval will vary from institution to institution, but generally, it shouldn’t take more than a 30-60 minute phone call, followed up with sending some documentation to your loan officer. They may request things like tax returns, pay stubs, or any other verification of income to provide the pre-approval.

Submit Your Highest and Best Offer

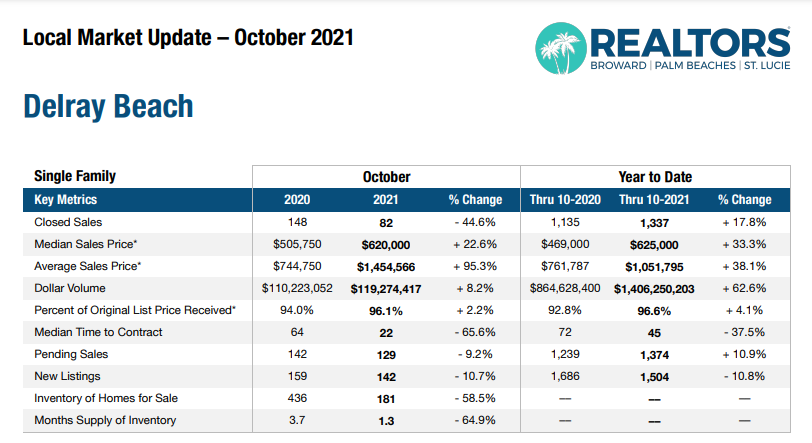

Submit your highest & best offer right away. Do not try to get the house at a steal. In October 2021 in Delray Beach, FL, homes are under contract in 22 days and at 96.1% of the list price.

Consider at what price will you be upset if you lose the home. If your offer is $250,000, and you lose the home to a buyer who offered $255,000, will you be upset? If so, your offer should have been higher in the first place. If not, you did well to stand your ground on your price. With listing agents often juggling multiple offers, and sellers contemplating multiple offers, many times buyers are not getting counter-offered. There may be no opportunity to re-bid on the home if the seller just goes with the best offer.

Escalation Clause

If you are weary to proceed with your best and highest offer, you could consider an escalation clause. This clause states that you are willing to bid up to a certain price and will outbid any other offers by an amount of your choosing. For example, you could submit an offer of $250,000 on a house, escalating up to a maximum of $300,000 and outbidding the next highest offer by $3,000. So if someone else offers $265,000, you would automatically offer $268,000.

The contract language would stipulate the details, but generally, the listing agent would need to provide proof of the other offers for your offer to escalate.

Delray Beach Housing Market Stats for October 2021

Cash is King & Bigger is Better

Buy with Cash

If it’s possible for you, submit an all-cash offer or an offer with a larger deposit and smaller financing amount. If you are paying cash for the home, that means the seller doesn’t need to worry about whether you can purchase the home or not, or whether you will finance a new toy right before closing and be denied the loan by the bank. Cash is king in real estate and for good reason.

Bigger is Better

If you cannot pay for the home with cash, as most people cannot, consider making your deposit on the home larger and reducing the financing amount. While it’s not as good as cash, buying a home with a 40% downpayment is significantly better for a seller than buying a home with a 5% down payment.

Why is that? Well, part of the home buying process is having an appraisal of the home. If a buyer is putting down more cash, the appraisal does not have to be a deal-breaker on the home loan. The buyer has enough cash to cover the difference if the appraisal comes in lower than the home value.

Submit a Larger Earnest Deposit

Your earnest deposit is a payment made towards the purchase of the home when you go under contract, which is typically held by a title company or by an attorney. The money is held in escrow (it doesn’t go to the seller just yet). The larger the deposit, the more serious the seller will take you. We suggest a deposit of at least 5%, but preferably 10%.

Do You Inspections Quickly!

Submit in your offer a quick inspection period. The longer your inspection period is, the more time you could still walk away from the deal(check your contract). From the sellers perspective, this means that the house is tied up and that it cannot be sold to anyone else, but they don’t have a guaranteed sale with you either. In a hot market, sellers are unwilling to take the home off the market for too long for the inspection period. The shorter your inspection the faster the seller has an actual deal, which makes them more confident in your offer.

Reduce Your Contingencies Where Possible

Sellers want to sell, and buyers want to buy, right? Contingencies get in the way of both of those. Present to the seller an offer with as few contingencies as possible. Contingencies get in the way of home sales, so sellers want as few as possible.

- Financing – Can you pay cash for the home? If you can, this would remove the financing contingency

- Appraisal – Can you cover the difference if the appraisal comes in lower than your office? Then you can waive the appraisal contingency.

- Inspection – Is this a home you would be willing to purchase without performing an inspecti0n? This is very risky and not recommended, but would remove the inspection contingency.

- Home Sale Contingency – Do you have a home to sell before buying this one? Can that be done without requiring it as a contingency?

Kick-Out Clause

If you must have certain contingencies, and these may take an extended period of time, you can always offer the seller a kick-out clause. This allows the seller to continue to market their home for sale in hopes of receiving another offer without contingencies. If they do, then you would need to decide whether to wave your contingencies or lose the home to another buyer. This may not sound like a good idea for a buyer, but it’s another tool to get you under contract on a home.

Find Out The Sellers Needs & Be Flexible

Don’t just think about what you want and need for the home and closing, but consider the sellers needs. This is where having a good realtor is important. Your realtor can find out information that isn’t shared online, and typically isn’t communicated via short texts or emails. A good realtor will make phone calls, have real conversations, and get details that could make or break your offer.

Does the seller need to close quickly? Then offer to close as soon as you can.

Does the seller want a delayed closing because they are also looking for a new home? Offer to delay closing up to 60, 90, or even 120 days if it works for you.

Does the seller need the cash now but needs time to find a new home? Offer the seller a lease back option where they can stay in the home and pay rent for however long is possible for you.

Does the seller want to leave the furniture that you do not want? No problem, just have everything discarded after closing.

Sellers are humans with lives of their own, and circumstances. There can be many things unsaid on a listing. If you can discover the sellers needs and wants, you can tailor your offer in a way that other buyers may not have even considered. Be flexible if you want your offer to stand out above the rest.

Final Words

Buying a house in a hyper-competitive market is difficult. Buyers are often submitting many offers on multiple homes, and still not getting anywhere. If you are serious about buying a home then using everything this guide talks about should get your offer considered and hopefully under contract! If this guide helped you get into your new home, please leave a comment below and let us know!

Disclaimer: Real estate laws vary state-by-state, and contracts vary as well. Consult with your real estate agent and attorney. This is meant as a guide, and not legal advice.