Every year the number of people moving to Florida continues to rise. Florida has been, for a while now, one of the fastest-growing states in North America. Many people perceive this to be due to the fantastic warm weather, but the secret truth behind all these moves has been the exceptional tax breaks that new Florida homeowners get.

Now, that’s great, but what can this mean for you?

In all honesty, moving to a new state and becoming a Florida resident is a big decision for anyone. If you’re one of the many who are interested in making the move, then there are plenty of reasons why this may be one of the best financial decisions you could make. What kinds of benefits can you obtain? Well, there are plenty of tax breaks for Florida homeowners.

These tax breaks can be filed for on your tax returns to help you save big at the end of the year!

You may be asking yourself what the tax benefits available are and how you can obtain them. There are quite a few ways you can benefit from becoming a homeowner in Florida, and there is no better time than the present to make the change. This quick guide will give you some insight to what tax breaks you can apply for as a Florida homeowner when you file an itemized tax return.

Young Professionals Relocating

An increasing number of young adults who work remotely are being drawn to Florida’s allure, seeking its sunny skies and vibrant lifestyle to complement their digital workspaces. The state’s beaches, entertainment, and year-round warmth are becoming a significant draw for the remote workforce looking for a balance of leisure and labor.

Sunshine Vs. Savings

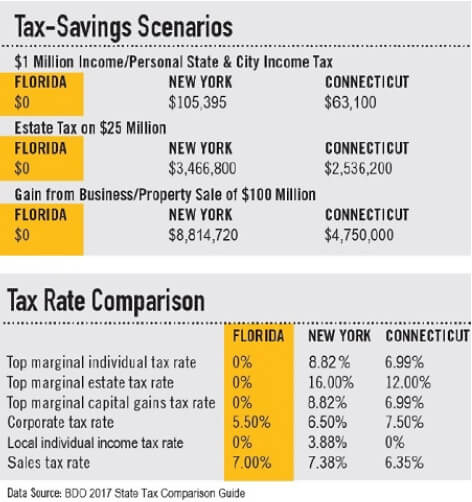

Florida is the Sunshine State, and this allure is a driving force for many who come to Florida as new residents. Truth be told, though, it is not the most prominent reason as the tax benefits are far more lucrative than the weather. How, do you ask? If you’re interested in finding out more, take a look at this breakdown of what ways you can benefit from a big move to the Sunshine State.

Mortgage Interest

When it comes to tax deductions, being able to make money back on your mortgage interest is one of the best benefits you can receive at the end of the year. When you \finalize the purchase of your new home, there is a set mortgage rate that is agreed upon and each month you pay a portion of interest in the payments. If you are the primary loan holder for the residence, you may have the opportunity to deduct a portion of your mortgage interest from your tax return.

No wonder so many new Florida residents choose to become homeowners!

If you’ve purchased a home in Florida after December 15th, 2017, then you are able to deduct mortgage interest from $750,000 on your loan debt. If you’re married and filing your tax returns separately, that maximum amount you can deduct from is $375,000 each. This is excellent news, right?

Before this is possible, you must meet some requirements. If you’re interested in deducting mortgage interest on your tax returns, then the home you are filing deductions for on your tax return would have to be either your primary or secondary residence. Turns out this is an easy requirement to meet!

There are different types of loans that you can deduct interest from. They are:

- Your first or second mortgage

- A home improvement loan

- A home equity loan

- A refinance loan

For any of these kinds of loans to be eligible, you must use the loan prior to filing your taxes. You must use the loan to either buy your home, build a new home, or greatly improve the state of your present home.

Pretty easy, right?

Real Estate Taxes

After you’ve secured your loan and finalized your Settlement Statement, there are notable fees to pay attention to as some of them are tax-deductible. When you purchase a new home, you are required to pay taxes on the real estate that you’ve purchased both at the state and local level.

How does this help you?

By making it possible to deduct your real estate taxes on your federal tax return! This includes the deductible from the real estate taxes you paid when you closed on your home. The total deductible that’s possible on your real estate taxes is a whopping $10,000 if you are filing as a married couple, or half of that amount if you’re filing separately.

That’s a real pretty penny, don’t you think?

Closing Costs

When you purchase a new home in the state of Florida, you will be met with closing costs. Simply put, you’ll have to pay a sum of money to secure the home in your name and these costs include taxes. What’s a perfect example? Your real estate taxes, of course!

As you already know, real estate taxes paid may leave you open to tax deductions at the end of the year. As if that’s not enough, there are also other fees that can be taken at the time of closing on your home that may be eligible for tax deductions.

The eligible tax-deductible payments are:

- Mortgage interest that you paid at the time of closing. These payments must appear on your Settlement Statement.

- Real estate taxes that you paid when you closed on your home. These will also appear on your Settlement Statement.

- When you receive your mortgage loan, you pay loan origination fees. These fees may be paid by you or the seller. In either case, you can deduct the total amount of loan origination fees if the new home you’ve purchased is your primary home. For you to be eligible for this deduction, these fees must be reflected on your Settlement Statement. There are other requirements you must meet, which you can find here.

You will not be able to get your Settlement Statement information from your lender, so be sure to keep a copy of your Settlement Statement on hand.

Your Personal Income Tax

When it comes to applying these principles to your personal income taxes, you may be wondering how you’d be affected by these tax benefits. One important key factor to know is that Florida is one of seven states without a personal income tax. What this means for you is that your income won’t be taxed throughout the year at the state level, but you also won’t receive a tax return for Florida state.

But wait, there’s more.

Becoming a homeowner in Florida can help you increase the amount of money that you receive at the end of the year with the tax benefits available to those who purchase a new home. In 2017, a bill was signed into law that set the maximum tax deductions at the state and local level at $10,000, and this includes real estate and income taxes.

How does this affect you as a Florida resident? As a new homeowner, you’ll still be able to apply $10,000 worth of tax deductions to your next tax return and you won’t have to pay income taxes either! Sounds rather excellent, doesn’t it?

Final Thoughts

These are just some of the few tax deductions that you can make at the end of the year when you become a new homeowner in Florida! The good news? There are even more benefits possible for you when you file an itemized tax return at the end of the year. This includes even more deductions if you’re a military home!

If you’re looking to move to Florida, finding your home with a company like SquareFoot can maximize your savings on top of your tax-deductible payments! With SquareFoot’s real estate rebates and these tax deduction opportunities, you can make thousands of dollars back on your new home purchase.

Incredible, right?

Now you’ll have plenty of reasons to make the move, and the Florida sunshine will be the icing on the cake.